Explore Strategies to Accelerate Innovation by Shifting Left FinOps: Part 3 in cloud environments.

Introduction

In nowadays’s fast-paced global of cloud computing, companies need to find methods to innovate without skyrocketing charges. That’s in which Accelerate Innovation by Shifting Left FinOps: Part 3 comes into play. By incorporating financial operations techniques early within the improvement technique, groups can streamline their cloud value control and unleash their innovation capacity. Imagine a seamless blend of creativity and performance, in which developers are empowered to make value-effective choices as they design and construct. Embracing this technique now not best optimizes budget usage but also ensures a proactive mindset in the direction of economic control, leading to elevated innovation.

Understanding Shift Left FinOps

The time period “shift left” may sound like a moveset cue in a dance competition, but within the realm of monetary operations, particularly in relation to cloud computing, it’s not anything short of modern. Shift Left FinOps is about reimagining economic strategies with the aid of shifting financial responsibility and insights earlier into the software development and cloud operation lifecycles. This manner developers and operations teams start thinking about economic influences long earlier than the very last billing statements hit their desks. Let’s dive into its definition, importance, and the important thing standards at the back of this idea.

Definition and Importance

Shift Left FinOps represents a strategic circulate to embed monetary control and duty into the early ranges of the software program development lifecycle. Traditionally, financial oversight in cloud environments is conducted retrospectively. The project is that by the point cloud payments arrive, the financial decisions have already been entrenched, leaving little room for maneuver.

This is in which “shift left” will become important. By integrating economic techniques into the sooner phases, businesses can higher manipulate costs, save you overruns, and optimize spending. This proactive method isn’t pretty much cutting expenses—it’s about empowering groups to innovate with out monetary surprises lurking right across the nook. With cloud spending projected to skyrocket inside the coming years, adopting Shift Left FinOps may be the difference between a finops framework that fuels innovation and one which stifles it.

Key Principles of Shift Left in FinOps

Adopting a Shift Left FinOps method isn’t simply approximately flipping a transfer; it’s a cultural transformation. Here are the important thing principles to manual you on this journey:

- Proactive Engagement: Involve monetary discussions at each level of the improvement method. It’s essential that financial practices are not an afterthought but an crucial part of the planning section.

- Cross-Functional Teams: Encourage collaboration among development, operations, and finance groups to ensure each person stocks the equal financial desires and metrics.

- Continuous Monitoring and Feedback: Establish a comments loop in which monetary impacts are constantly monitored and reviewed so changes can be made in real-time.

- Education and Training: Equip teams with the right know-how about fee control and cloud optimization techniques. When anybody is aware the monetary implications in their selections, better picks are made.

- Cost Transparency and Accountability: Visibility into charges ought to be a given, now not a luxurious. Ensure each member of the crew has get admission to to value data and is aware their role in controlling it.

These principles pave the manner for a extra based and disciplined method in coping with price range, which in the end quickens innovation.

Strategies for Accelerate Innovation by Shifting Left FinOps: Part 3

Accelerating innovation while coping with charges may feel like strolling a tightrope. Balance is fundamental, and Shift Left FinOps can lead the way. Here we explore numerous strategies that allow organizations to embody this stability, therefore fueling innovation.

Integrating Financial Accountability Early

One of the fundamental steps in transferring monetary management left is by ensuring monetary accountability is a part of the preliminary conversations and choice-making techniques. This may consist of:

- Budgeting in Tandem with Project Development: Involve finance and finances teams at some stage in the task planning ranges to align budgetary constraints and expectancies with the technical roadmaps.

- Implementing FinOps Practices in DevOps: Embed FinOps practitioners in developer and operations teams to provide insights on price-effective resources and tools for the duration of making plans and implementation.

- Setting Clear Financial Objectives: Establish economic desires at the onset of initiatives. Whether it is value savings or most appropriate resource utilization, clean goals guide groups on wherein to attention their innovation efforts.

These steps assist make sure that the task not best meets technical targets but also aligns with or even exceeds monetary dreams.

Enhancing Team Collaboration and Responsiveness

For a Shift Left FinOps to actually take root, fostering a collaborative tradition is paramount. Here’s a way to enhance collaboration and responsiveness:

- Unified Dashboards and Reporting Tools: Invest in equipment that offer shared insights into price and utilization metrics for all teams. When anybody sees the equal records, they’re more likely to work toward common financial dreams.

- Regular Cross-Departmental Meetings: Regular sync-up sessions between technical and financial groups inspire talk and make sure all people is at the equal web page concerning mission goals and monetary influences.

- Agile Methodologies for Financial Response: Just as agile practices have revolutionized software program improvement, adopting agile strategies in economic control can make budgeting and forecasting more conscious of unexpected changes.

- Celebrating Financial Wins Together: Acknowledge and have fun when tasks come below finances or whilst efficiencies are found out. This reinforces superb conduct and strengthens the way of life of economic obligation.

These collaborative techniques now not best assist manipulate prices better but additionally unlock thoughts and innovations that won’t have in any other case surfaced.

Leveraging Data-Driven Decision Making

In the digital era, records is the brand new oil, and on the subject of FinOps, it’s the fuel that drives choice-making:

- Informed Resource Allocation: Use historic and real-time statistics to expect aid desires and allocate them more effectively. Data insights can highlight regions ripe for optimization, stopping over-provisioning or wastage.

- Utilizing Advanced Analytics: Employ predictive analytics and AI to foresee traits, potential overruns, and areas of inefficiency, allowing for changes properly before they effect the bottom line.

- Automated Cost Analysis and Reporting: Automation tools can sift via full-size quantities of data to provide concise reviews and dashboards, supporting groups make faster, informed decisions.

- Experimentation with Minimal Risk: Empower teams to check new thoughts and technology on a smaller scale. Data-driven insights will help examine feasibility and monetary viability before complete-scale implementation.

A statistics-driven method equips corporations to now not most effective react swiftly to modifications but also to assume them—making sure a smoother path to innovation.

By embedding economic accountability early, enhancing group collaboration, and leveraging records-driven decision-making, agencies can ensure their Accelerate Innovation by Shifting Left FinOps: Part 3 strategies do not simply keep them afloat but propel them ahead into groundbreaking innovations. Together, these strategies create a strong framework that supports agile economic practices, in the end permitting groups to consciousness on what actually subjects—delivering present day solutions without the fear of monetary constraints.

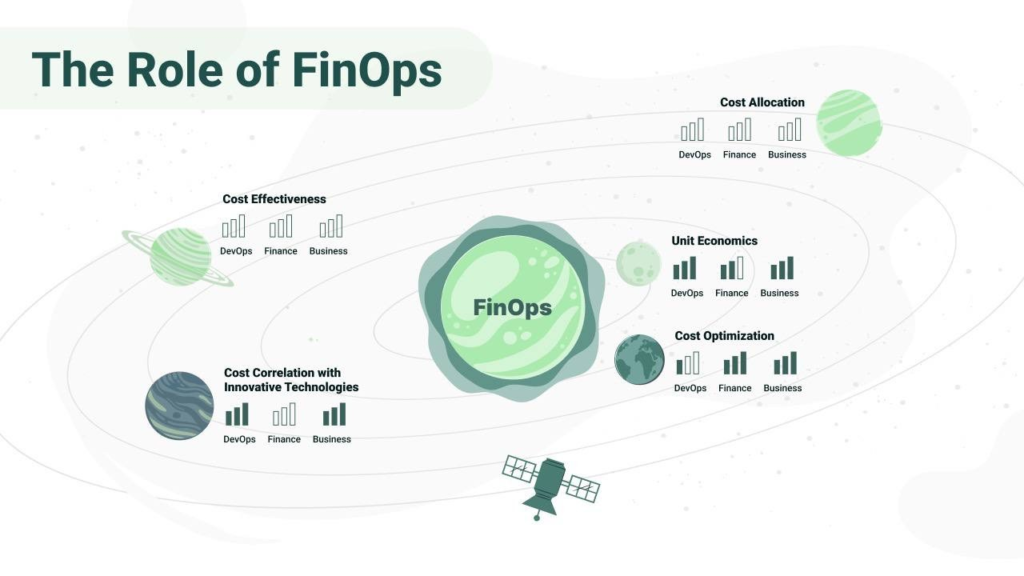

Optimizing Cloud Costs thru FinOps

In modern day unexpectedly evolving virtual landscape, corporations are keen to boost up innovation through optimizing their cloud charges. FinOps, or Financial Operations, affords a strategic method to gain this aim by moving left—or integrating monetary insights and price control in advance in the development process. Let’s dive into a few key practices on how to make use of FinOps to optimize cloud fees while fostering innovation.

Identifying Cost-Effective Practices

One of the first steps in optimizing cloud charges is coming across price-effective practices that align along with your business enterprise’s needs. This includes an intensive assessment of present day cloud utilization and pinpointing regions wherein assets may be over-allotted or underutilized. Here are some sensible steps to keep in mind:

- Right-Sizing Resources: Analyze your cloud times and alter their length to match the real call for. This prevents over-provisioning and reduces needless costs.

- Reserved Instances and Savings Plans: Commit to reserved times or cloud provider savings plans to advantage from lower costs for sustained workloads.

- Spot Instances and Discounts: Take advantage of cloud providers’ spot times for bendy, interruptible obligations, which typically cost much less than trendy times.

Implementing those practices calls for a collaborative approach, with monetary and technical groups running collectively to create a price-aware subculture. Additionally, developing a FinOps crew to screen and optimize cloud spending can further enhance cost performance.

Implementing Automated Financial Monitoring

Automation plays a crucial role in retaining cloud fees in take a look at whilst encouraging innovation. Automated monetary monitoring gear offer actual-time visibility into cloud fees, permitting businesses to behave swiftly and effectively. Here’s how automation can support your FinOps approach:

- Budget Alerts and Notifications: Set up computerized signals to notify groups whilst spending processes the budget restriction, bearing in mind prompt adjustments and selection-making.

- Cost Anomaly Detection: Employ system studying algorithms to hit upon sudden price spikes and address them right now, stopping steeply-priced overruns.

- Real-Time Reporting: Use automatic dashboards to provide up to date fee insights. This transparency builds accountability throughout departments and encourages statistics-pushed decisions.

Integrating automatic monetary tracking ensures non-stop oversight of cloud prices. Not best does this empower corporations to manage charges efficiently, however it additionally frees up sources to recognition on innovation.

Continuous Improvement and Feedback Loops

A successful FinOps strategy is in no way static. It flourishes on non-stop improvement and nicely-dependent feedback loops that align with business desires. Cultivating an surroundings wherein feedback is frequently collected and acted upon can significantly propel innovation and cost optimization.

- Regular Review Meetings: Hold periodic FinOps conferences to assess modern-day practices, assessment financial statistics, and discover areas needing adjustment or improvement.

- Cross-Functional Collaboration: Encourage enter from diverse groups—development, finance, operations—to advantage particular views on value and overall performance.

- Iterative Approaches and Experiments: Experiment with new tactics or equipment in a controlled surroundings to gauge their effectiveness earlier than complete-scale implementation.

By embedding non-stop improvement and comments mechanisms on your FinOps approach, you can perceive and put off inefficiencies, live adaptable to changes, and assist innovation. This proactive approach ensures that your organization not most effective stays competitive however also operates with a monetary acumen that drives lasting achievement.

By adopting these FinOps strategies, organizations can boost up innovation, optimize cloud fees, and stay in advance within the dynamic virtual marketplace. Embracing a shift-left mindset in coping with finances fosters a tradition of duty, collaboration, and consistent boom.

Conclusion

In a international in which innovation units the tempo, Accelerate Innovation by Shifting Left FinOps: Part 3 technique may be a game-changer. By incorporating fee management early inside the development technique, organizations can liberate new stages of performance and creativity. Imagine having the foresight to scale cloud resources dynamically or to first-rate-music costs meticulously. With these FinOps strategies, now not best do you champion innovation acceleration, however you also domesticate a culture that prospers on collaboration and ahead-thinking. Embrace the shift, and watch your potential leap!